Blue Carbon: Financing the UAE’s Next Frontier in Climate Action

October 8, 2025 /General

By Dr Deepti Mahajan Mittal (ENWWF), Marina Antonopoulou (ENWWF) and David Ramos (HSBC)

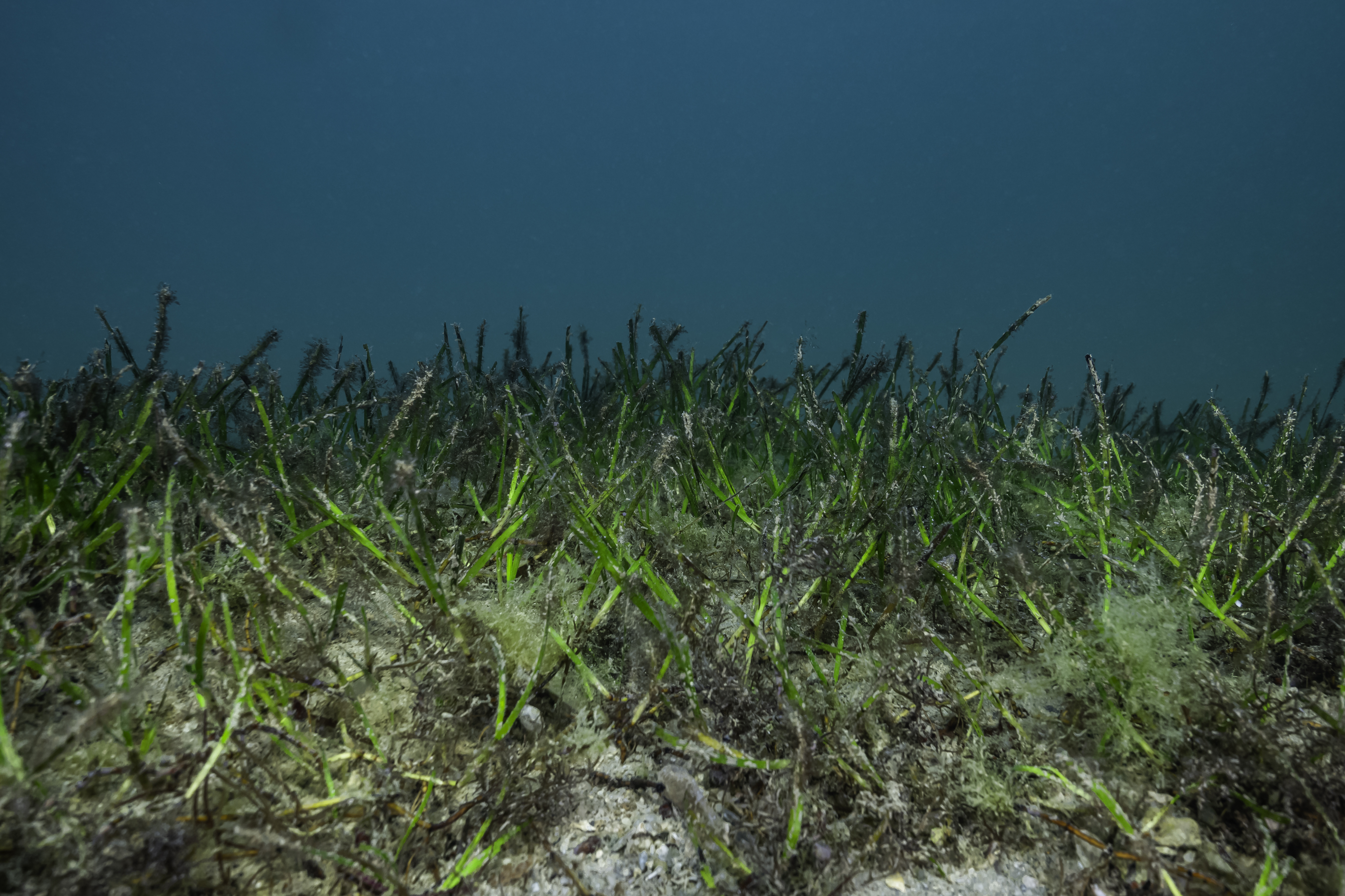

Coastal blue carbon ecosystems – such as mangroves, seagrass, mudflats and saltmarshes – are among the UAE’s most valuable natural assets for climate mitigation and adaptation. They provide multiple ecosystem services essential for human wellbeing and economic resilience. They capture and store carbon, shield coasts from erosion, support fisheries and biodiversity, purify water and create opportunities for eco-tourism. Despite this immense value, the conservation and restoration of these ecosystems remain underfunded.

Mobilising finance for coastal blue carbon ecosystems is both an environmental necessity and an untapped economic opportunity. With the IUCN World Conservation Congress convening environmental leaders, policymakers and investors in Abu Dhabi, this is a timely moment to advance meaningful discussions on how to scale finance for nature projects.

To inform these dialogues, Emirates Nature-WWF has launched Financing Nature-based Solutions for Climate Mitigation – an insights paper developed under the HSBC-funded Climate Solutions Partnership. The paper delves into the challenges and opportunities in scaling finance for Nature-based Solutions (NbS), particularly in UAE’s coastal ecosystems, the potential to leverage market-based carbon finance and ways to enhance viability of such projects.

Building a stronger business case

Carbon finance mechanisms, particularly carbon markets, have emerged as a growing avenue to channel private sector funding into blue carbon projects. Voluntary carbon markets have gained traction even while persistent integrity concerns highlight the need for high-quality, transparent and impact-driven NbS initiatives.

Challenges remain, including limited large-scale opportunities, high project costs, and lengthy verification processes. In the context of the UAE’s unique coastal ecosystems – which are relatively small in expanse and less productive – market-based carbon mechanisms should therefore be viewed as one element within a diverse portfolio of revenue generation streams, rather than a stand-alone solution.

Unlocking the true potential of blue carbon ecosystems requires bundling carbon benefits with other ecosystem services – and ensuring these initiatives are scaled up and adapted to local contexts. Diversifying income streams in this way reduces risk, builds more resilient business models, and allows a wider range of stakeholders to share in the benefits. Combining carbon credits with co-benefits such as biodiversity conservation, water filtration, sustainable fisheries and ecotourism opportunities, strengthens the business case of NbS projects, offers the potential for commanding a premium price and attracts a broader pool of investors.

It is important to note that while both avoidance credits (which prevent the loss of natural carbon sinks) and removal credits (from restoration activities such as afforestation, reforestation and revegetation) are vital for ecosystem integrity, markets tend to favour removals, as these are generally easier to demonstrate and verify.

The UAE has taken significant steps, including establishing a National Carbon Registry and other regulatory measures, which can support the growth of carbon markets and mobilize public and private capital towards climate mitigation projects. Such measures create new opportunities to channel private investment into Nature-based Solutions.

Innovating financial instruments for nature

To bridge the nature financing gap, innovative instruments are being developed. Blended finance structures, which combine public, philanthropic and private capital – and foster public–private partnerships – can de-risk projects and attract institutional investors. Blue bonds, outcome-based bonds and impact investment vehicles can mobilize large pools of capital. Sustainability-linked loans and bonds can tie performance indicators directly to nature-based outcomes.

Carbon revenues, generated through voluntary carbon markets or national mechanisms, can serve as the foundation of a wider finance package. Around this core, other instruments can be layered:

- Instruments and models, like Blue Bonds, that raise funds in private capital markets to deliver impact

- Early-stage or seed investments, like Incubation Funds, that invest in the growth of SMEs pioneering NbS.

- Mechanisms such as Nature Resilience Funds that blend private investment with concessional or public capital.

Together, these instruments can build a diversified financing ecosystem capable of sustaining long-term conservation and restoration.

Enabling conditions for scale

To facilitate investments into NbS in blue carbon ecosystems, coordinated action by public and private actors is essential. Six priority areas stand out:

- Enhancement of data and monitoring: Expand national and sub-national coastal habitat inventories, carbon accounting and ecosystem service assessments to underpin financing.

- Development of high-quality projects: Bundle carbon avoidance and removals with biodiversity, water management and disaster risk reduction to maximize returns.

- Adoption of ecosystem approach: Manage mangroves, seagrass, and salt marshes as interconnected habitats to optimise carbon storage and resilience.

- Integration of blue carbon into policy commitments and mechanisms: Align NbS with national climate and biodiversity commitments to attract private capital.

- Leverage market frameworks: Ensure upcoming UAE market mechanisms support blue carbon credits at competitive pricing.